How do I allocate a fuel bill that is 80% business and 20% private in Xero?

Where do I allocate monthly website upkeep and hosting expenses too in Xero?

Where do I allocate car registration in Xero?

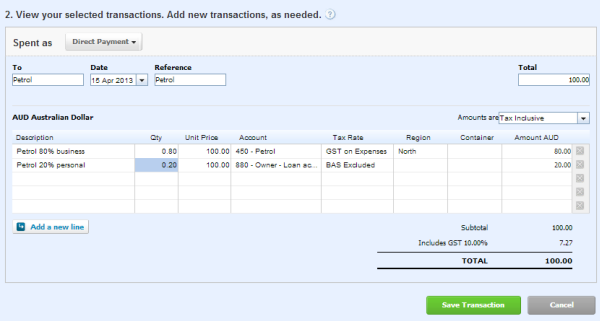

How do I allocate a fuel bill that is 80% business and 20% private in Xero?

Make sure you have two accounts: petrol EXPENSE account, and owners loan account (LIABILITY) account. When reconciling, click on View details on the far right hand side, to access the Direct Expense screen. Enter the details as follows:

How do I record transactions made from my business savings account to my business credit card account in Xero?

When reconciling opt for the Transfer tab, and select the Business Credit Card account from the drop down menu.

Where do I allocate monthly website upkeep and hosting expenses too in Xero?

Website upkeep & hosting can be allocated to an expense like advertising. If your business was actually your website, like EBAY, or Google, then money spent, might be considered an asset.

Where do I allocate car registration in Xero?

Car registration can be allocated to an expense like vehicle registration, or simply motor vehicle expense. Check the GST

I am in Australia. How do I reconcile my wages in Xero?

The payroll needs to be processed before the wages can be reconciled.

Payroll>Pay Run>Create Draft Bill>Approve Bill> then you can reconcile the wages expense.

Wage does not have GST allocated to it, and are deemed BAS Excluded.